Recently, RBI released a research paper, titled ‘Peeling the Layers: A Review of NBFC Sector in Recent Times’. The paper highlights new regulations for NBFCs and how NBFCs performed in 2023. In this piece, I have summarised that paper.

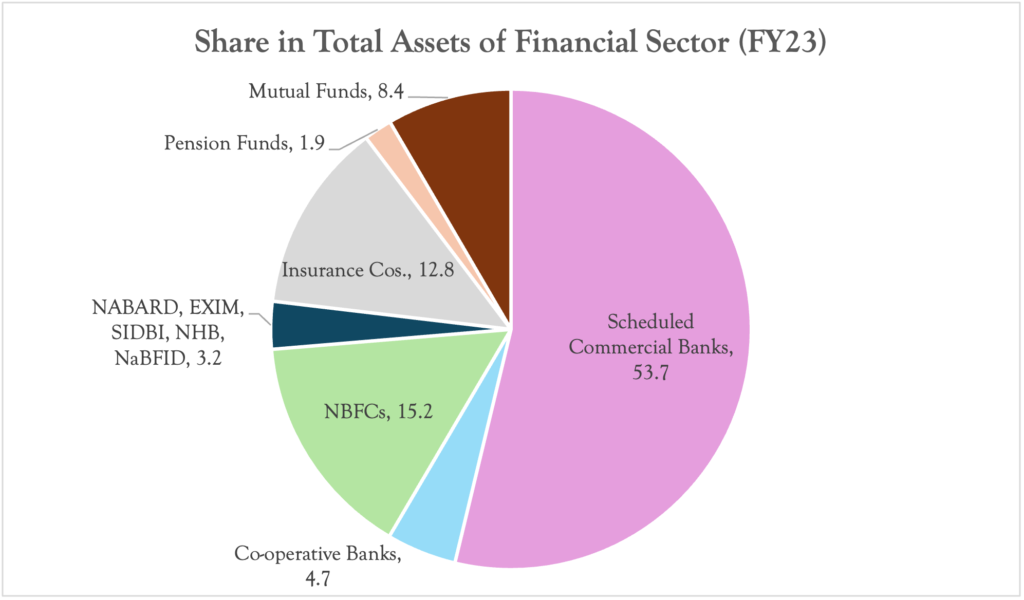

In India, the financial system remains bank-dominated. But the Non-Banking Financial Institutions (NBFI) sector is growing rapidly. NBFIs are not restricted to Non-Banking Financial Corporations (or NBFCs) but include anything which is not a central bank or commercial bank. The gap between them is closing over time. Their systemic importance is increasing, as indicated in the size of NBFIs as a share of GDP.

History of NBFC Regulations

Since 1964, RBI has been regulating NBFCs under the RBI Act, 1934 (which was amended in 2021). In 1998, NBFCs were categorised based on acceptance of public deposits, followed by the introduction of systemic importance for non-deposit-taking NBFCs (NBFC-ND-SI) with an asset size of ₹100 crore and above in 2006.

A few of the regulations were changed after some years like raising ₹100 crore limit to ₹500 crore. The minimum Tier 1 capital requirement was raised to 10% from 7.5% along with bringing asset classification norms in line with that of banks.

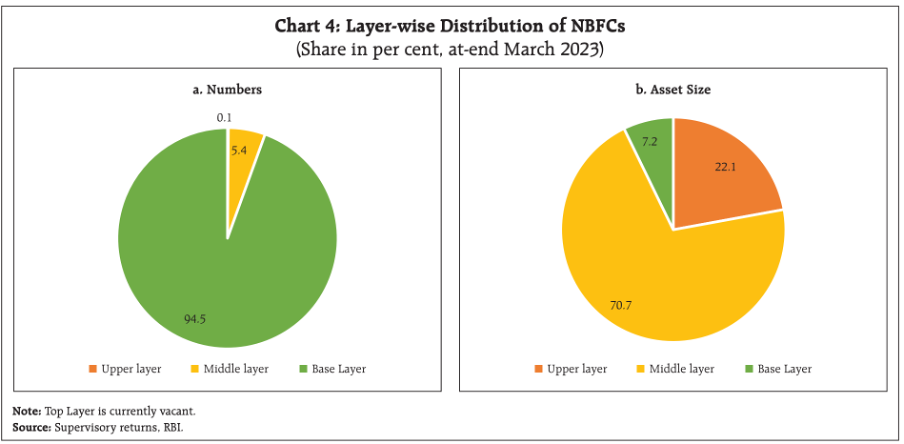

The most recent came in through Scale-Based Regulation (SBR). SBR came into effect on October 1, 2022. Under this, NBFCs are placed in any of the four layers (top, upper, middle, and base) based on size, activity, or perceived riskiness. Refer to one of my previous articles on the SBR framework here.

NBFCs in the base layer are subject to less stringent regulation than those in the middle and upper layers. As of March 2023, nine upper layer NBFCs were contributing to one-fifth of total assets. However, for FY24, 15 NBFCs were included in the upper layer.

Assets: Rise of Unsecured Lending

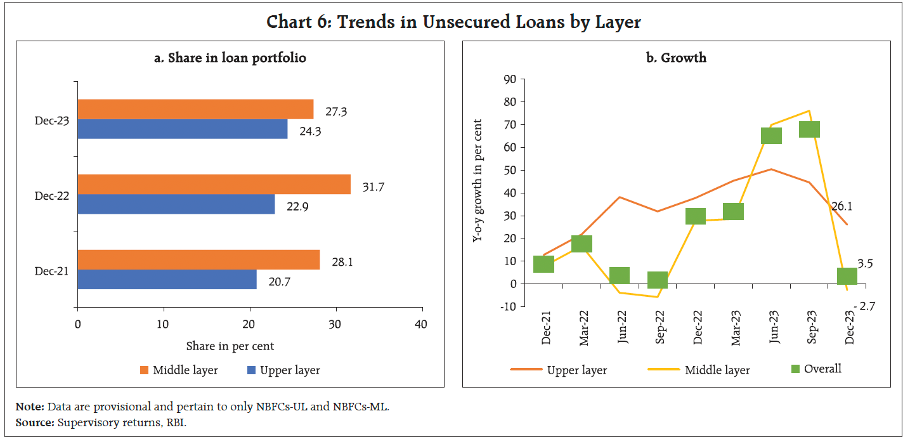

In November 2023, RBI increased risk weights on certain categories of retail loans by NBFCs, addressing concerns about high growth in consumer credit components. This measure moderated the growth of unsecured loans. Unsecured loans constituted around 26% of NBFCs’ credit. After this announcement, it showed steep growth, especially among middle-layer NBFCs, but has decelerated thereafter.

Over 70% of NBFC credit is directed toward the industry and retail sectors. By the end of December 2023, the industry accounted for around two-fifths of the total credit. Credit to industry, services, and retail sectors grew in double digits, while growth in agriculture and allied activities moderated due to the base effect.

Retail sector credit growth was driven by strong lending in vehicles, consumer durables, gold loans, and credit card receivables.

Liabilities: Growth in Bank Borrowings Decelerate

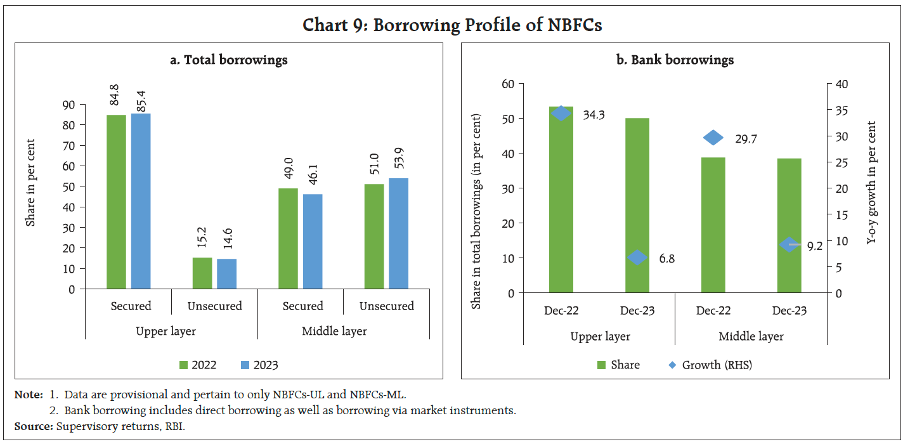

Banks remain the dominant source of funds for NBFCs, both through direct lending and indirect subscription to debentures and commercial paper issued by NBFCs.

The RBI increased risk weights on bank lending to NBFCs in November 2023, encouraging NBFCs to diversify their funding sources. This resulted in a sharp deceleration in NBFCs’ borrowing from banks, particularly among NBFCs-UL.

Improved Performance

Profitability has improved across the sector, with NBFCs-UL showing better performance due to lower provisions against NPAs and interest expenses. The GNPA ratio has declined across sectors, with retail loans showing the lowest GNPA despite high unsecured lending. Both NBFCs-UL and NBFCs-ML are well-capitalized to meet regulatory requirements.

Conclusion

The NBFC sector remains resilient, with adequate capital, robust credit growth and low delinquency ratios. NBFCs are diversifying their funding sources and reducing reliance on bank borrowings. Going forward, NBFCs need to stay vigilant of emerging risks, especially in cybersecurity and climate risk, and bolster their assurance functions to ensure sustainable growth.

I’ve been writing about the GRC (governance, risk management, and compliance) framework on LinkedIn and my blog.

Follow me on LinkedIn for more information and subscribe for updates on compliance, NBFCs, BFSI, etc.

Subscribe to my newsletter directly to your email inbox: https://bfsicompliance.info/subscribe-for-alerts/