NBFCs have played a significant role in India’s development. They play a crucial role in the financial system that banks do not necessarily provide. They have grown in size and complexity and, thus, need robust regulatory treatment. To this end, the RBI has brought new regulations for NBFCs.

History of Scale-Based Regulations

On 19th October 2023, RBI published Master Direction – Reserve Bank of India (Non-Banking Financial Company – Scale Based Regulation) Directions 2023 (or SBR Master Directions). These replaced earlier frameworks: (i) Non-Banking Financial Company–Non-Systemically Important Non-Deposit taking (Reserve Bank) Directions, 2016, and (ii) Non-Banking Financial Company–Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016.

On 4th December 2020, RBI, in its Statement on Developmental and Regulatory Policies, announced the need for a revised framework for regulating NBFCs. A month later, on 22nd January 2021, it released a discussion paper titled ‘Revised Regulatory Framework for NBFCs – A Scale-based Approach’. Based on the inputs from stakeholders, on 22nd October 2021, it was announced that the new guidelines would come into effect on 1st October 2022. However, some rules around IPO funding will be applicable from 1st April 2022 onwards.

Old Regulations

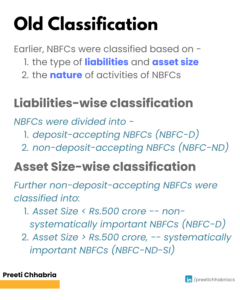

Previously, NBFCs were classified based on i) the type of liabilities and asset size; and (b) the nature of activities of NBFCs.

In the former, they were divided into deposit-accepting (also called NBFC-D) and non-deposit-accepting NBFCs (NBFC-ND). Further, based on the asset size, NBFC-NDs were classified as systematically important (NBFC-ND-SI) and non-systemically important NBFCs (NBFC-ND). If the asset size was less than Rs. 500 crore, it was classified as NBFC-ND and if it exceeded Rs. 500 crore, it was called NBFC-ND-SI.

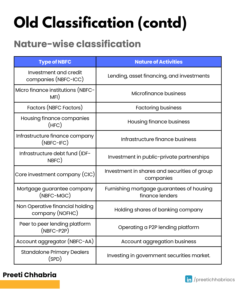

In the latter, they were divided into various types depending on the business. For example, if it engaged in microfinance, it was called a Microfinance Institution (NBFC-MFI), or if the business was investing in shares and securities of Group Companies only, they were called Core Investment Companies (CIC), and so forth. The following table lists out different types of NBFCs based on the nature of activity:

New Regulations

From 1st October 2022, new regulations are set in, known as Scale Based Regulations. Under this framework, RBI has introduced four scale-based layers viz. base, middle, upper, and top.

Here’s the snapshot of the new scale-based regulations:

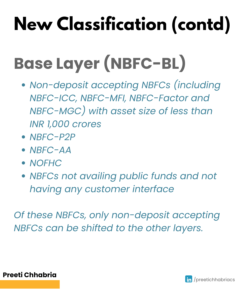

The base layer includes Non-deposit accepting NBFCs (including NBFC-ICC, NBFC-MFI, NBFC-Factor and NBFC-MGC) with asset sizes of less than INR 1,000 crores, peer-to-peer platforms, and account aggregators, to name a few.

It includes the following NBFCs:

- Non-deposit accepting NBFCs (including NBFC-ICC, NBFC-MFI, NBFC-Factor and NBFC-MGC) with asset size of less than INR 1,000 crores

- NBFC-P2P

- NBFC-AA

- NOFHC

- NBFCs not availing public funds and not having any customer interface

Of these NBFCs, only non-deposit–accepting NBFCs can be shifted to the other layers.

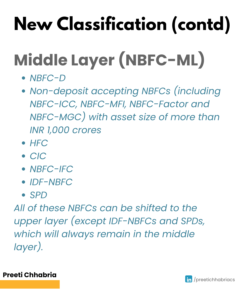

The middle layer includes deposit-accepting NBFCs, NBFC-NDs with asset sizes of more than INR 1,000 crores, housing finance companies, CIC, etc.

It includes the following NBFCs:

- NBFC-D

- Non-deposit accepting NBFCs (including NBFC-ICC, NBFC-MFI, NBFC-Factor and NBFC-MGC) with asset size of equal to or more than INR 1,000 crores

- HFC

- CIC

- NBFC-IFC

- IDF-NBFC

- SPD

All of these NBFCs can be shifted to the upper layer (except IDF-NBFCs and SPDs, which will always remain in the middle layer).

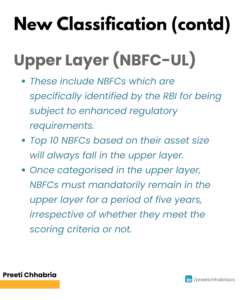

The upper layer includes those which are specifically identified by the RBI as being subject to enhanced regulatory requirements. Moreover, the top 10 NBFCs will always remain in this layer. Once categorised in the upper layer, NBFCs must mandatorily remain in the upper layer for five years, irrespective of whether they meet the scoring criteria or not.

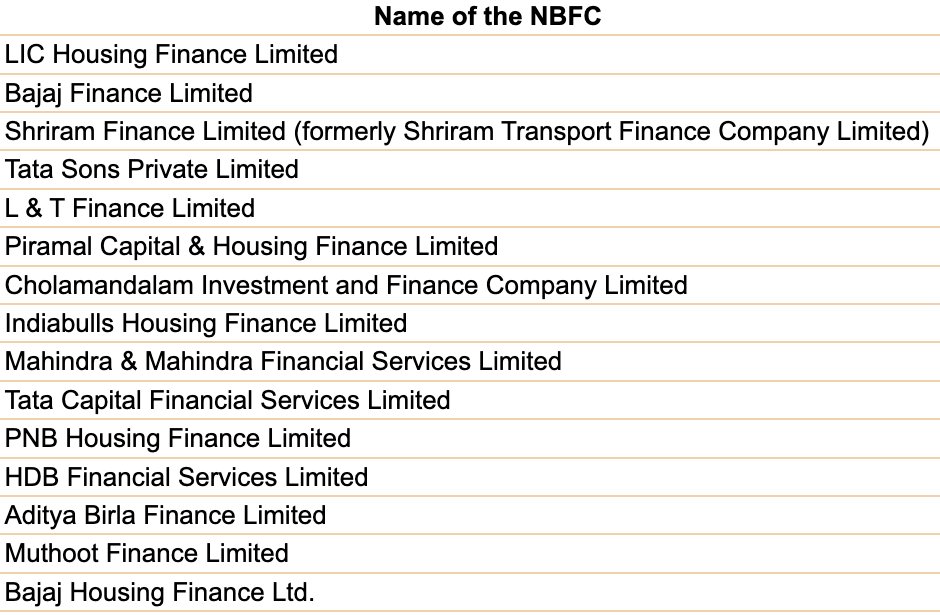

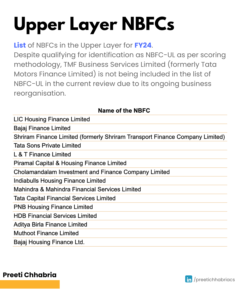

The following NBFCs have been classified under the upper layer for FY24:

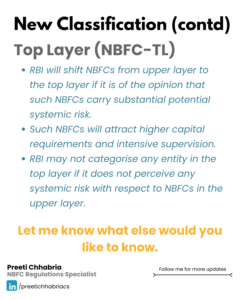

The top layer, however, will most likely be empty. The RBI will shift NBFCs to this layer if it believes that such NBFCs carry substantial potential systemic risk. Such NBFCs will be subject to enhanced and intensive supervisory engagement by the RBI and even higher capital requirements.

Multiple NBFCs in a Group

NBFCs that are part of a common Group or are floated by a common set of promoters shall not be viewed on a standalone basis. That means the total assets of all the NBFCs in a Group shall be consolidated to determine the threshold for their classification in the Middle Layer While consolidating the asset size at Group level all NBFCs need to be considered including NBFCs which will always remain in Base Layer – NBFC-P2P, NBFC-AA, NOFHC and NBFC without public funds and customer interface.

If the consolidated asset (consolidation as per above) size of the NBFCs in the Group is ₹1000 crore and above, then each NBFC-ICC, NBFC-MFI, NBFC Factor and MGC lying in the Group shall be classified as an NBFC in the Middle Layer and consequently, regulations as applicable to the Middle Layer shall be applicable to them.

Over and above these regulations, RBI brings amendments and additional rules and regulations from time to time. The SBR has been introduced to address the changing risk profiles of NBFCs. Experts across the board have cheered these regulations.

Follow me on LinkedIn for more information and subscribe for updates on compliance, NBFCs, BFSI, etc.

Subscribe to my newsletter directly to your inbox: https://bfsicompliance.info/subscribe-for-alerts/

Comments (1)

𝐀 𝐑𝐞𝐯𝐢𝐞𝐰 𝐨𝐟 𝐍𝐁𝐅𝐂 𝐒𝐞𝐜𝐭𝐨𝐫 𝐢𝐧 𝐑𝐞𝐜𝐞𝐧𝐭 𝐓𝐢𝐦𝐞𝐬 𝐛𝐲 𝐑𝐁𝐈 – Preeti Chhabriasays:

October 25, 2024 at 11:21 am[…] The most recent came in through Scale-Based Regulation (SBR). SBR came into effect on October 1, 2022. Under this, NBFCs are placed in any of the four layers (top, upper, middle, and base) based on size, activity, or perceived riskiness. Refer to one of my previous articles on the SBR framework here. […]